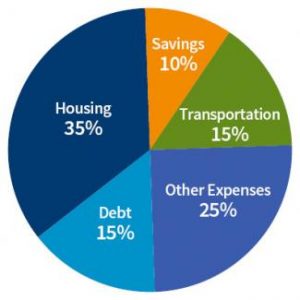

Recommended Budget Guidelines

When it comes to money, there’s certainly no shortage of ways for us to spend it, but where should our money really be going? Below are some suggested benchmarks. To learn more, join VCU HR for “Living Off Your Paycheck” on Tuesday February 19th at 12 noon in Cabell Library, Room 250. You can register here for the class.

Housing

Spend no more than 35% of net income on housing. Depending on whether you rent or own, that can include: mortgage/rent, utilities, insurance, taxes, and home maintenance.

Savings

Save at least 10% of income throughout your working life. Make sure you have 3-6 months income in an emergency fund before you start saving for other goals.

Transportation

Spend no more than 15% of net income on transportation. That includes: car payment, auto insurance, tag or license, maintenance, gasoline, and parking.

Debt

Spend no more than 15% of net income on all other consumer debt: student loans, retail installment contracts, credit cards, personal loans, tax debts, and medical debts.

Other

Spend no more than 25% of net income on all other expenses: food, clothing, entertainment, childcare, medical expenses, tithing/charity, and vacations.

Do remember that these are simply guidelines, not hard-and-fast rules. Every financial situation is unique, but assessing your budget on a regular basis to make sure it fits the suggested guidelines is a good way to stay on track and avoid future problems.