Conditions Ripe for Fraud

Compliance Corner – Issue 1.5

46. That’s the percentage of organizations reporting some type of fraud in Pricewaterhouse Cooper’s Global Economic Crime and Fraud Survey 2022. And within those organizations, 57% of the fraud reported occurred with some assistance from an employee.

But before you assume that Big Business bears the brunt of losses from fraud, consider higher education. A report by Transparency International summed things up by saying “the very structure and culture of colleges and universities, as well as the current constraints under which many…operate, can create conditions that facilitate fraud.”

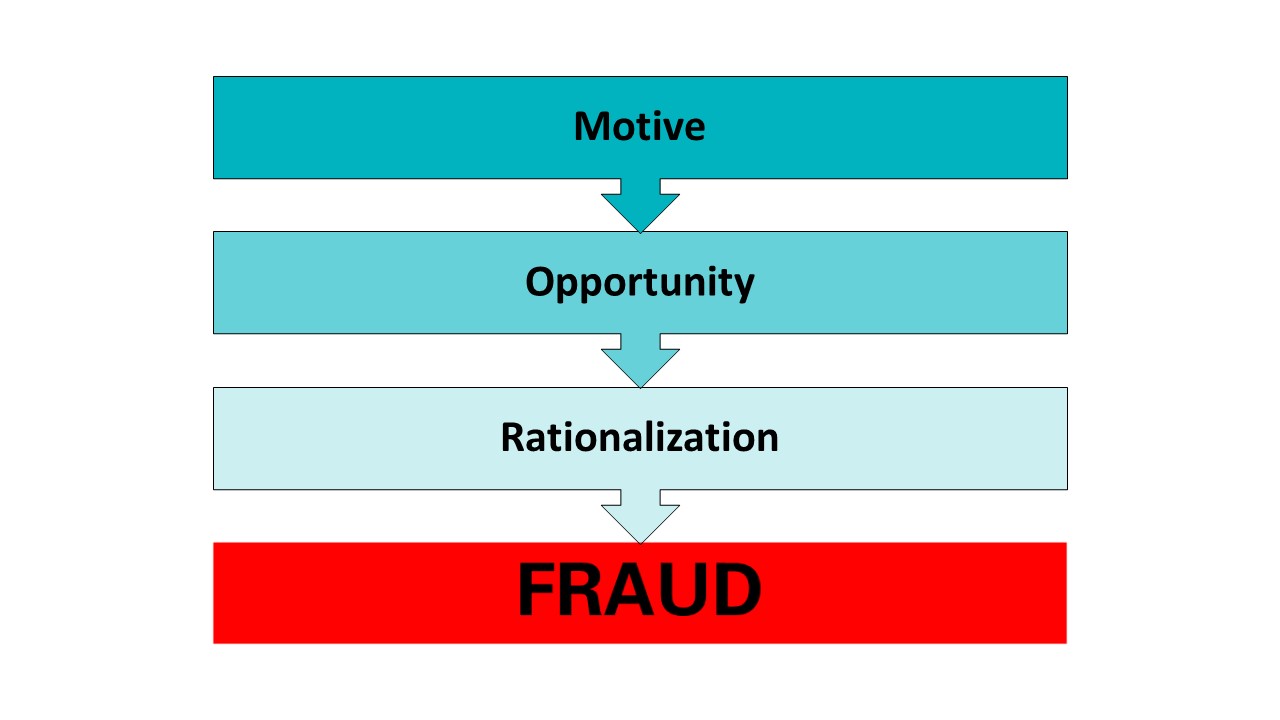

So, what are the conditions that facilitate fraud? Most people agree there are three: Motive, Opportunity, and Rationalization.

Condition #1: Motive – (Sometimes referred to as Pressure.) This is what drives someone to commit fraud. Maybe it’s their lack of funds; maybe it’s the lure of “easy money.” Maybe it’s something else, like seeking revenge. Whatever the reason, once they decide to take action, they look for Condition #2.

Condition #2: Opportunity – Someone planning to commit fraud won’t succeed unless the opportunity presents itself. And this is where organizations sometimes make it easy. Are there systems or processes that are outdated or inefficient? Do access and other internal controls exist and function correctly? Is there any oversight? Are internal audits performed? Is management paying attention? Once the person committing fraud takes advantage of the opportunity when it presents itself, they are ready for Condition #3.

Condition #3: Rationalization – This is the trickiest of the conditions because, as Clay M. Kneipmann says in his article “The Fraud Triangle,” “it takes place in the mind of the perpetrator.” Fraudsters often justify their actions by creating their own morality around why it’s OK to commit the fraud. They tell themselves things like, “It’s just this once,” “No one will ever find out,” “They owe it to me after all these years.”

Most of us would agree that we have little control over Conditions 1 or 3 (although fostering a culture of integrity should help); but how about Condition #2? How does your department or unit measure up? Are you giving would-be fraudsters the opportunity to commit fraud? Take a look around and determine where it is that you are vulnerable and do whatever is needed to eliminate that risk.

When the conditions are ripe for fraud, it will likely happen. So, don’t let the conditions for fraud ripen – nip them in the bud.

Did You Know??….Committing fraud as a state employee in the Commonwealth of Virginia can lead to losing your benefits, up to and including your pension. That’s right! Anyone paying into the Virginia Retirement System who commits fraudulent activity leading to a charge and conviction of a felony (involving amounts greater than $500) could lose that retirement.

For more information, see The Code of Virginia, Title 51.1, Chapter 1, Article 1.1.

If you aren’t sure what fraud can look like in the workplace, take a look at these examples from the FAQs section of the VCU Fraud Identification and Reporting Requirements policy, page 4, or check-out this infographic on Red Flags for Fraud.

Read about two cases of fraudulent activity investigated by VCU’s Integrity and Compliance Office in this month’s Compliance Case Study.